texas estate tax return

Ad Complete IRS Tax Forms Online or Print Government Tax Documents. You are subject to pay 2545800 in federal estate taxes.

Talking Taxes Estate Tax Texas Agriculture Law

This is NOT a fill-in-the-blank form.

. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Form 706 must generally be filed along with any tax due within nine months of the decedents date of death. Power of Attorney Forms.

Up to 25 cash back You as executor can file the estates first income tax return which may well be its last at any time up to 12 months after the death. An estates executor is responsible for filing all applicable tax returns on behalf of the estate. Texas state and local governments generate revenue.

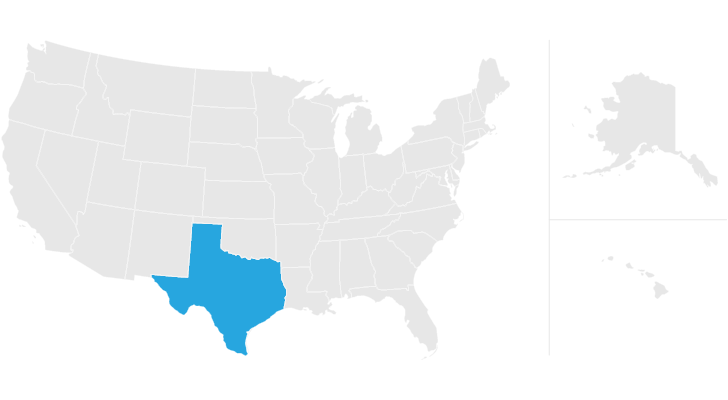

TurboTax has no info on your website. Texas is one of seven states which do not levy a personal income tax. The executor or administrator is required to among other things prepare and file all of the tax returns due both for the decedent and for the.

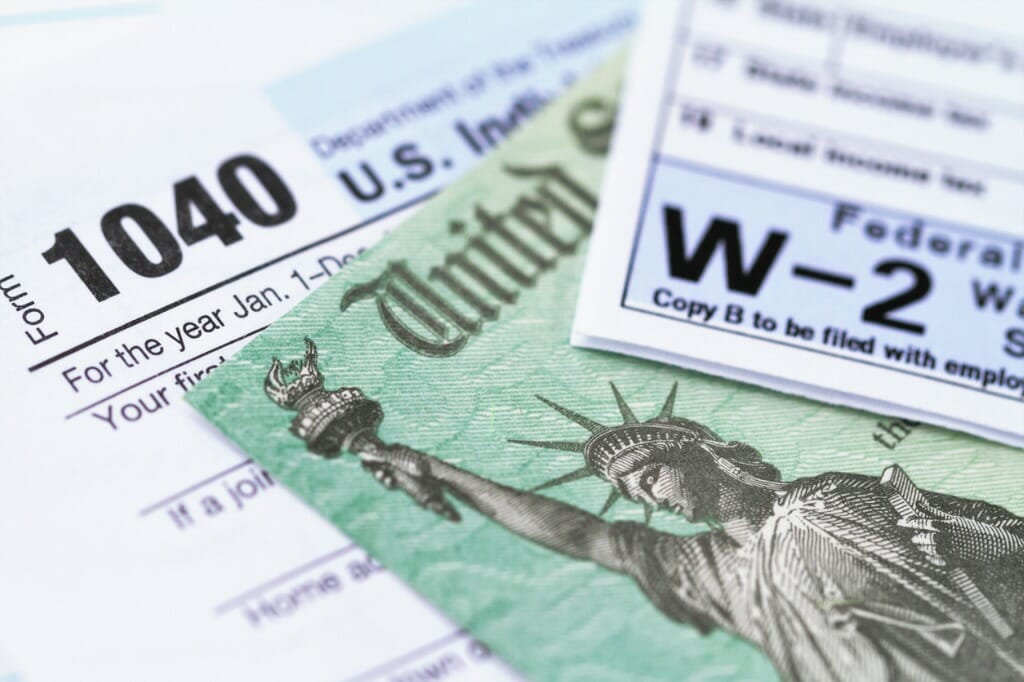

Only if the deceased person left a very large amount of propertyworth more than 1206 million for deaths in 2022will you need to file a federal estate tax return. Sexually Oriented Business Fee Forms. There are two kinds of taxes owed by an estate.

His assets were held in a living trust that became an irrevocable trust upon his death. When the gross estate is less than the. Your executor will file an estate tax return with the IRS and pay any taxes due.

If your estate is worth 1756000. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. But it TurboTax says I have to file a state business income tax return in Texas.

The estate executor must file an estate tax return when the gross estate meets or exceeds the filing threshold based on the date of death. Ad Complete IRS Tax Forms Online or Print Government Tax Documents. Printable State Income Tax Forms and Instructions.

Texas has neither an estate tax a. Texas IRS and State Tax Form Deadlines. Deceased Taxpayers Filing the Estate Income Tax Return Form 1041.

Ad Download Or Email TX 01-114 More Fillable Forms Register and Subscribe Now. 0 1 773 Reply. Apr 15 th Individual.

Texas has no inheritance tax so any money you receive as a beneficiary is not charged state tax income tax property tax or capital gains tax. The responsibility falls on the trustee rather than the executor if all of the. If a decedent has sufficient assets that are not offset by deductions his or her estate will be subject to the federal estate tax.

The Texas estate tax system is a pick-up tax which means that TX picks up the credit for state death taxes on the federal estate tax return. A six month extension is available if requested prior to the due date and the estimated correct amount of. But in TX this credit is no longer.

Feb 28 th W-2 W-3 1099s filing date. The 1041 federal return was for the estate of my father who died in the middle of 2018. One on the transfer of assets from the decedent to their.

2022 Texas Franchise Tax Report Information and Instructions PDF No Tax Due. 1 2016 to be filed electronically. A Closer Look The Matter of Texas Probate Taxes.

Natural Gas Tax Forms. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The law requires all No Tax Due Reports originally due after Jan.

31 rows Generally the estate tax return is due nine months after the date of death. This is because the amount is. 3 However not every estate needs to file Form 706.

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. Mixed Beverage Tax Forms. Jan 15 th 4 th quarter individual estimated tax payments.

It depends on the. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. The tax period must end on the.

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. Since there is no longer a federal credit for state estate taxes on the federal estate tax return there is no longer basis for the Texas estate tax.

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

:max_bytes(150000):strip_icc()/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

Form 709 United States Gift And Generation Skipping Transfer Tax Return

State Corporate Income Tax Rates And Brackets Tax Foundation

All The Weird Ways People Have Tried To Avoid Paying Taxes History

Filing Taxes For Deceased With No Estate H R Block

Double Taxation How Small Businesses Can Avoid It Smartasset

Texas Estate Tax Everything You Need To Know Smartasset

How To Close An Estate In Texas Romano Sumner

:max_bytes(150000):strip_icc()/IRSForm4506Page1-b54ccd93aa56416595fe32b49d670d67.jpg)

Form 4506 Request For Copy Of Tax Return Definition

Texas Estate Tax Everything You Need To Know Smartasset

Do I Have To Pay Taxes On Foreign Inheritance To The Irs International Tax Attorney

2022 Filing Taxes Guide Everything You Need To Know

Texas Inheritance And Estate Taxes Ibekwe Law

The Basics Of Fiduciary Income Taxation The American College Of Trust And Estate Counsel

2021 Tax Deadline Extension What Is And Isn T Extended Smartasset

What To Do If You Receive A Missing Tax Return Notice From The Irs

Do I Have To Pay Taxes On Foreign Inheritance To The Irs International Tax Attorney