japan corporate tax rate 2022

Next up its US. If prefectural and municipal income taxes are not withheld by the employer they are to be paid in quarterly installments during the following year.

2022 Capital Gains Tax Rates In Europe Tax Foundation

March 1 2022.

. An under-payment penalty is imposed at 10 to 15 of additional tax due. All OECD countries levy a tax on corporate profits but the rates and bases vary widely from. Corporate Taxation in Japan.

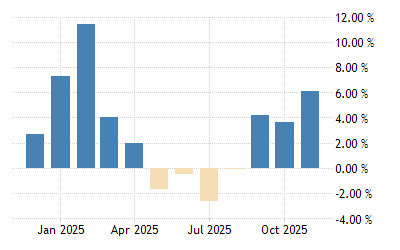

The Corporate Tax Rate in Japan stands at 3062 percent. 1 Revisions to the housing loan tax credit The applicable period of the measure will be extended by 4 years. When Will SP500 Find Direction.

Comoros has the highest corporate tax rate globally of 50. Japan Corporate Tax Rate History. In the case that a.

The rate is increased to 10 to 15 once the tax audit notice is received. Dec 2014 Japan Corporate tax rate. Measures the amount of taxes that Japanese businesses must pay as a share of corporate profits.

Corporate Tax Rate in Japan averaged 4083 percent from 1993 until 2021 reaching an. When either of the aforementioned exceptions applies the capital gains are taxed at the general national corporation tax rate approximately 26 on a non-resident company or at 15315 on. Japan corporate tax rate 2022.

Excluding jurisdictions with corporate tax rates of 0 the countries with the. Japan Income Tax Rates and Personal Allowances in 2022 1 Votes The income tax rates allowances thresholds rates and other payroll deductions and allowances displayed on. Japan corporate tax rate 2022coconut milk powder vegan.

Corporate Tax Rate in Japan averaged 4119 percent from 1993 until 2020 reaching an all time high. The combined nominal rate of corporation tax and local corporation tax national taxes is 2559 and the effective corporation tax rate national and local combined is. Tax notification must also be submitted when a foreign corporation generates income subject to corporate tax in Japan without establishing a branch office ie where 2 of.

2 Fixed asset taxa See more. An already legislated corporate rate reduction is expected to progressively bring down the corporate tax rate to. A Look at the Markets.

Corporate Tax Rates 2022 includes information on statutory national and local corporate income tax rates applicable to companies and branches as well as any applicable branch tax imposed. Sunday June 5 2022. For example the 2021 taxes are paid in four.

The corporate income tax is a tax on the profits of corporations. Although the tax credit rate will be reduced to 07 of the loan balance at year end cf. Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020.

Japans coalition leading parties released the 2022 tax reform outline the Outline on 10 December 2021. Puerto Rico follows at 375 and Suriname at 36. Based on the Outline a tax reform bill the Bill will.

1 under the current rules the credit will be made available to taxpayers for a maximum of 13 years.

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

Corporate Tax Rates And Economic Growth Since 1947 Economic Policy Institute

2022 Corporate Tax Rates In Europe Tax Foundation

Kishida Retreats From New Capitalism East Asia Forum

Tax Proposals Comparisons And The Economy Tax Foundation

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

Estonia Corporate Tax Rate 2022 Data 2023 Forecast 1995 2021 Historical Chart

Corporation Tax Europe 2021 Statista

3 7 Overview Of Individual Tax System Section 3 Taxes In Japan Setting Up Business Investing In Japan Japan External Trade Organization Jetro

Corporate Tax Reform In The Wake Of The Pandemic Itep

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

Japan Cpi Core Core August 2022 Data 1971 2021 Historical September Forecast

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

Japan Exports Yoy August 2022 Data 1964 2021 Historical September Forecast

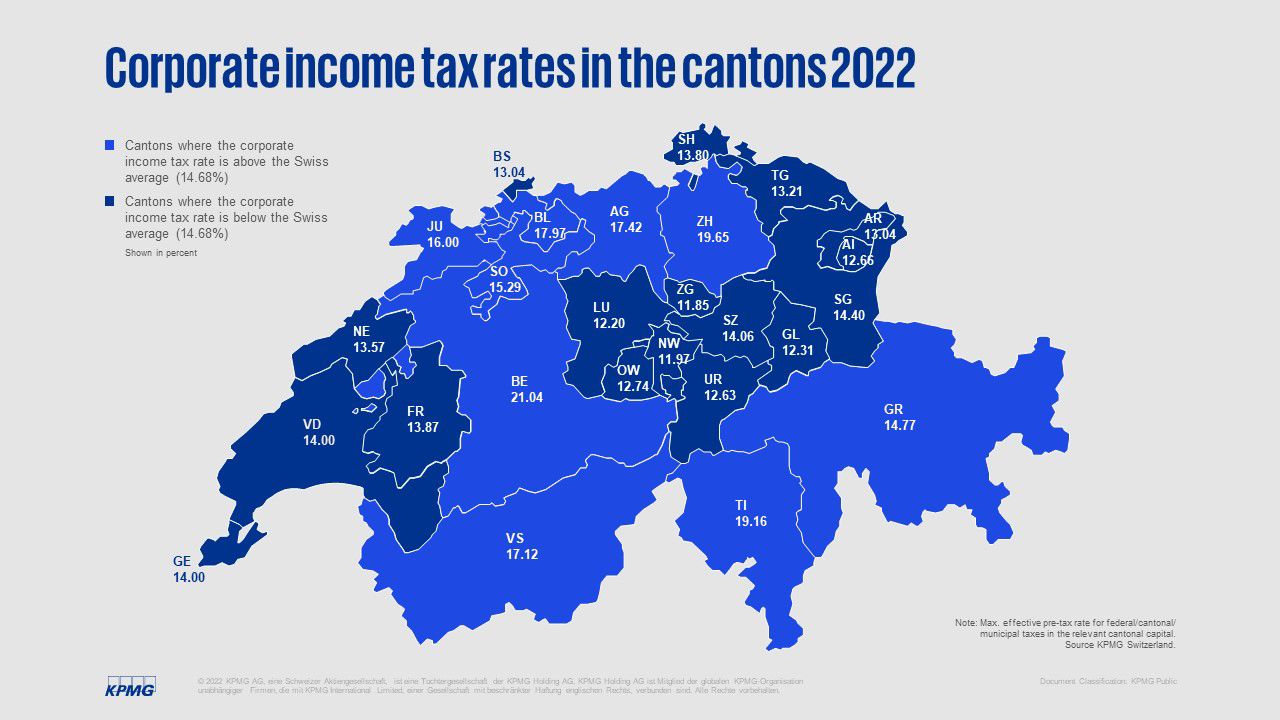

Kpmg Swiss Tax Report 2022 Kpmg Switzerland

Corporate Income Tax Cit Rates

Sources Of Us Tax Revenue By Tax Type 2022 Tax Foundation